Australia’s Architecture Industry in 2024: Challenges, Priorities, and Innovations

Rising costs, builder insolvency and challenges related to regulatory compliance top the challenges facing studios in 2024, a cohort of leading Australian architects have warned.

The exclusive insights have come from the BCI Construction Outlook, which offers valuable feedback from key market players, including builders, developers and architects.

The report unpacks and discusses the wide-ranging challenges facing Australia’s construction industry as well as current business focuses and anticipated work volumes across 2024.

The survey insights are supported by national, state and sector-based pipeline data trends spanning Q3 2021 to Q3 2024—extracted from BCI platform’s, LeadManager and Analytix.

Opportunities and challenges amid pipeline patterns and trends

In late 2022, BCI Central noted a peak in the value of early-stage projects, followed by a sudden drop in early 2023 and a gradual decline throughout the year. Despite this, the volume of nationwide project proposals suggests sustained high activity levels.

NSW/ACT, Victoria, Queensland and Western Australia collectively represent nearly 80% of project proposals during the report period.

Investments in community and public buildings, and energy sectors comprise over half of early-stage project values, totaling 55% in Q3 2023.

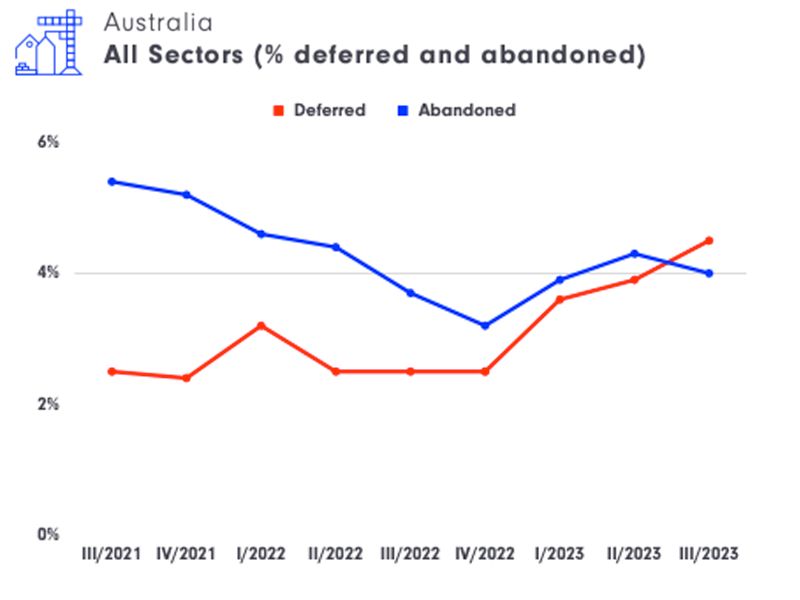

While abandonment rates are slowing, after rising between Q4 2022 and Q1 2023, the rise in deferral rates signals the turmoil currently faced by the construction industry as several factors causes constraints on construction firms and owners/businesses alike.

Avtar Lotay, Managing Director of RSHP, told BCI Central, each project carries an element of risk.

“As part of a global studio with a diverse portfolio, we believe we are well versed in the variety of challenges and opportunities projects can bring, our ability to understand, calibrate and mitigate risks is essential in moving forward in these times,” Lotay said.

“Currently, we are navigating the market conditions, particularly in sectors which seem to be static and perhaps suggesting a potential upswing around 2024 or thereabouts.”

Projects commencing and exiting the pipeline between Q4 2023 and Q3 2024 are being led by the industrial, infrastructure and transport sectors which, together with the energy and resources sectors, are contributing more than 60% of total project values for this period.

“For Grimshaw, our primary sector is transport,” Benjamin Donohoo, Principal at Grimshaw, said.

“The potential to unlock space around stations and within the Metro framework, particularly through transit-oriented development, presents a substantial opportunity for the housing sector, which is experiencing a significant challenge.”

Architects navigate challenges amid rising costs and regulatory concerns

Although the peak of the pandemic has passed, its enduring effects continue to impact architects throughout Australia who are currently contending with a complex array of challenges, including rising inflation and escalating material costs.

A notable 83% of surveyed architects expressed concerns about “cost escalation” while 41% flagged “builder insolvency” and 40% “regulations and compliance”.

Sally Stansborough and Sarah Swincer, Senior Architects at SMFA, encourage a proactive approach, noting the importance of understanding, calibrating and mitigating risks in the face of high construction costs.

“We have found that early contractor engagement or the involvement of quantity surveyors has assisted with managing this risk,” Stansborough and Swincer said.

“But, even with continual cost checks throughout the design and approvals process, there has still been a general trend in increasing construction costs for clients overall.”

Donohoo echoed the sentiment, stating that the most significant risk in the industry currently is inflation, which is driving up construction costs.

“Developers are grappling with questions on how to lock in suppliers early or design for on-site improvements,” Donohoo said.

“Our approach within projects, focusing on Design for Manufacturing and Assembly (DFMA), has been integral in sectors like aviation and education. In Australia, this concept is gaining momentum, following the UK’s lead.

“The ongoing inflationary pressure is pushing developers towards adopting these strategies.”

Architectural Priorities in 2024

BCI surveyed studios across Australia to understand their design and specification practices, including factors influencing product selection and reasons for product swaps.

Nearly 60% of respondents have in-house specification writers, while just under half use specification templates in Excel or Word.

40% of respondents reported that 10% - 30% of specified products are swapped for alternatives, primarily due to “cost”, followed by “availability” and then “lead times”.

“Cost,” “Australian-made,” and “aesthetics” continue to be the most crucial factors in product and service specifications. Notably, architects are increasingly emphasizing "safety," acknowledging the need for enhanced building standards in an industry plagued by defects.

“Sustainability” also lifted in importance among architects specifying products and services, with many stressing its significance. To address this, stakeholders advocate for greater encouragement to embed sustainability priorities into project feasibility, supported by improved regulations and prioritisation of green finance in line with the Paris Climate Agreement’s goals.

Torsten Burkhardt, Associate Partner at RSHP, highlighted the role of sustainable practices in achieving positive outcomes, as seen in projects like Barangaroo International Towers in Sydney.

“It’s a holistic approach that involves thoughtful consideration of the entire lifecycle of the built form—from the materials used in construction and energy consumption during its existence to planning for recycling or adaptation once its lifecycle is complete,” Burkhardt said.

Respondents see industry challenges in 2024 as a chance for “innovation” in upcoming projects, though it ranks eighth in importance when specifying products and services. They stress the potential to work with cutting-edge technologies to address systemic issues.

Want to learn more about the current state of the Australian construction industry?

Download your free copy of the BCI Construction Outlook.

Indonesia

Indonesia

New Zealand

New Zealand

Philippines

Philippines

Hongkong

Hongkong

Singapore

Singapore

Malaysia

Malaysia